National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function (ELSS: Edvinsson, Lin, Ståhle P. & Ståhle S.), a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

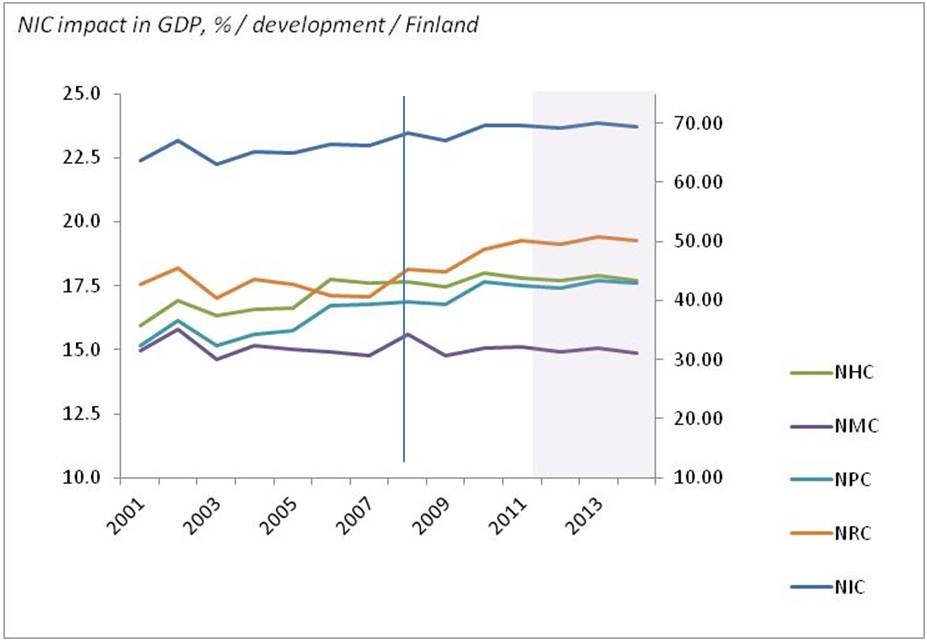

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

NIC backgroundIndeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

>> Find out more about NIC and GDP formation, build up <<How well is your country utilizing intangibles and potentials hidden in those? Login to see.

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

>> Find out more about NIC and GDP growth <<How are intangibles boosting your country and are effective one prioritized? Login to see.

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

>> Find out more about how NIC boosts recovery <<How are your country benefiting intangibles in the recovery process? Login to see.

We are working on a show case for you showing how "strong impact of a driver in USA differ from impact of same driver in China" ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

>> Find out more about how NIC SWOT analysis is performed <<Weak and strong NIC drivers in your country: Are they identified? Login to see.

We are working on a show case for you showing how impacts come fast or slowly and showing that these time lags are, not only driver, but also country specific ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

Are fast impacting intangibles in your country pin-pointed? Login to see.

We are working on a show case for you showing how "Expensive in India may be cheap in Germany" and how cost efficiency for same driver vary by country, time and situation ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

RCA / Finland vs Sweden 2012Which are the most cost effective intangible drivers in your country: Is money spent wisely? Login to see.

We are working on a show case for you showing how some drivers turn into neccessary pillars of the knowledge economy sustaining, but not boosting, the economy while new drivers emerge, boosting the economy. Decline of NIC impacts may even drive the whole country towards a tipping point ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

Tipping point estimates / 2012How well are emerging new drivers identified in your country? Is there a risk for a tipping point? Login to see.

We are working on a show case for you showing how different NIC drivers impact GDP growth, employment, domestic spending and government debt formation (among others) with varying time lags and how this impact is country specific and situational ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

What are the full impacts of NIC drivers, intangibles, in your country? Login to see.

We are working on a show case for you showing how all these stories put together can be used to outline action plans and good policies for your country and its future development ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

Want to look closer at data that really matters for your country and its future development? Login to see.

We are working on a show case for you ...

National intangible capital (NIC) explains major parts of world GDP growth and GDP formation.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function, a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

Indeed: Intangibles matter! And it matters even more to know exactly how they impact our economy.

And where are your country on the NIC map? Login to see.

Analysis tools and visualizations make use of geo-, bar-, trend-, radar- and scatterplot- charts together with tables, lists, heath- and tree- maps.

Analysis views and templates combine these to give you informative and effective views analysing the data and making it easy for you to spot trends, strengths, weaknesses, opportunities and threats in the development of your country's effective use and build-up of intangible capital resources and potential.

We mainly use Tableau software to do the hard work, but also other software tools are used.

Select year and variable to compare for all or just some countries in database.

Color scales indicates value of variable for different countries and when hovering over a country details are shown in a popup window.

Select year(s) and variable(s) to compare for one or several countries in database.

Bar height indicates value of variable and when hovering over a bar details are shown in a popup window.

Click to enlarge

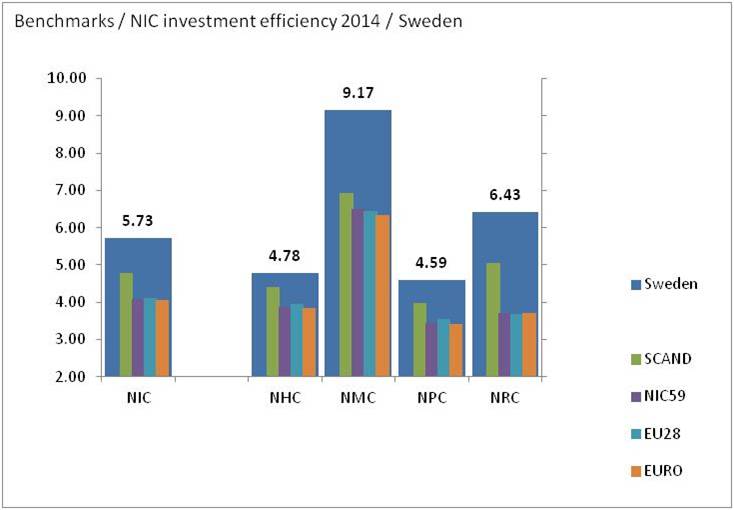

When focusing on indexes it looks as if human and process capital (NHC and NPC) would under perform for Sweden when compared to Scandinavia in general.

Click to enlarge

When focusing on indexes it looks as if human and process capital (NHC and NPC) would under perform for Sweden when compared to Scandinavia in general. Click to enlarge

However ... .. .

Click to enlarge

However ... .. .  Click to enlarge

Find out more and find out what the situation and developments are in 2016 by loging into NIC 2016 database.

Click to enlarge

Find out more and find out what the situation and developments are in 2016 by loging into NIC 2016 database.

Select desired time span and variable(s) to compare for one or several countries in database.

Line height indicates value of variable for given time span and when hovering over a line details are shown in a popup window.

Growing / declining trends can easily be seen and also abnormal anomalies / crisis behavior.

Click to enlarge

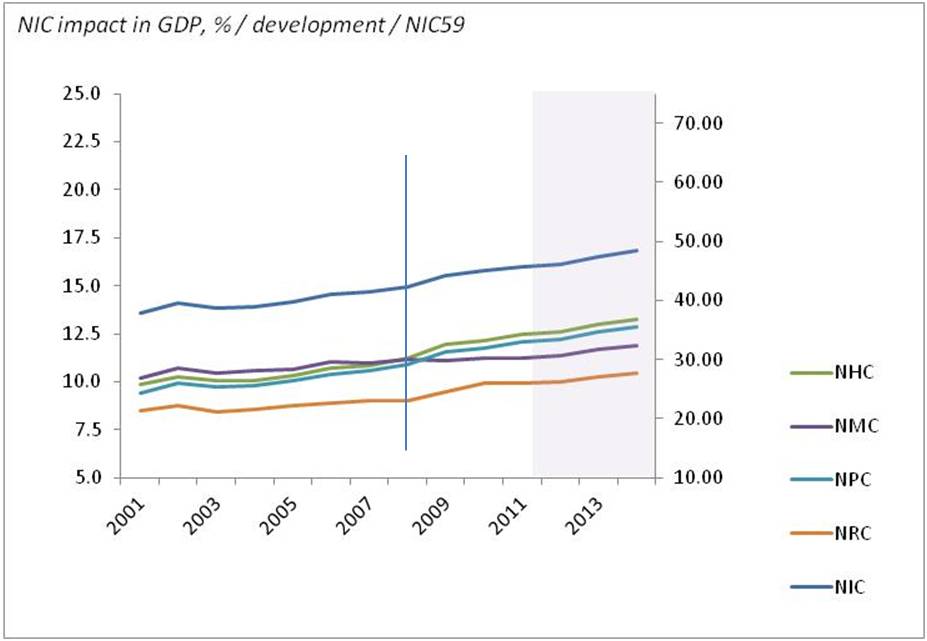

Taking the world in perspective it seems that the crisis had only minor causations disturbing the overall trend, contnuing growth.

Click to enlarge

Taking the world in perspective it seems that the crisis had only minor causations disturbing the overall trend, contnuing growth. Click to enlarge

After a short dip 2008-2009 process and renewal capital, not only recover, but perform with a better growth rate. At the same time human and market capital are back on original growth track.

Click to enlarge

After a short dip 2008-2009 process and renewal capital, not only recover, but perform with a better growth rate. At the same time human and market capital are back on original growth track.  Click to enlarge

Crisis 2008-2009 hits Finland and only renewal capital shows a positive response like for Sweden.

Click to enlarge

Crisis 2008-2009 hits Finland and only renewal capital shows a positive response like for Sweden. Click to enlarge

Denmark turns crisis into opportunity and moves to new levels of NIC impact and growth. And, even if the major leap has been made, the new growth trends for human, process and renewal capital are better than befor the crisis.

Click to enlarge

Denmark turns crisis into opportunity and moves to new levels of NIC impact and growth. And, even if the major leap has been made, the new growth trends for human, process and renewal capital are better than befor the crisis.

Select year(s) and variable groups x and y (and z) to plot for one or several countries in database.

X-horisontal axis, Y-vertical axis and Z size

Position x-y and size z of marker indicates value of variable x-y-z for one or selected countries and when hovering over a marker/bubble details are shown in a popup window.

National Intangible Capital NIC consists of four basic dimensions according to the model by Edvinsson & Malone (1997). This model has been further developed, now consisting 48 different indicators representing the four main categories.

Intangible Capital is Human Capital ,Market Capital (networks), Process Capital (infrastructure), and Renewal Capital (innovation).

Through dynamic mutual interaction with Financial Capital these factors of intangible capital affect the economic growth.

You find a thorough and in-depth introduction to the ELSS production function approach here:

Skilled labor (NHC1)

Employee training (NHC2)

Secondary education up enrollment (NHC3)

Pupil-teacher ratio (NHC4)

Public expenditure on education (NHC5)

15-64 years old population (NHC6)

Qualified engineers (NHC7)

Students PISA performance (NHC8)

Human Development Index (NHC9)

Gender equality (NHC10)

Years of education (NHC11)

R&D researchers (NHC12)

Corporate tax encouragement (NMC1)

Cross border venture (NMC2)

Openness of culture (NMC3)

Transparency of government policies (NMC4)

Image of your country (NMC5)

Capital availability (NMC6)

Trade to GDP ratio, exports + imports (NMC7)

Current account balance %GDP (NMC8)

Investment flows %GDP (NMC9)

Country credit rating (NMC10)

Investment risk (NMC11)

Globalization index (NMC12)

Business competition environment (NPC1)

Government efficiency (NPC2)

Computer per capita + Mobile subscribers (NPC3)

Internet subscribers + Broadband subscribers (NPC4)

Convenience of establishing new firms +start up days (NPC5)

Goods & services distribution efficiency (NPC6)

Overall productivity (NPC7)

Unemployment % + Youth unemployment % (NPC8)

Consumer price inflation (NPC9)

Health & environment (NPC10)

Corruption (NPC11)

Freedom of speech (NPC12)

Business R&D spending (NRC1)

Basic research (NRC2)

R&D spending/GDP (NRC3)

R&D US$ per capita (NRC4)

IP right protection (NRC5)

Utility Patents/ R&D expenditure (NRC6)

Cooperation between corporations and university (NRC7)

Scientific articles (NRC8)

Patents per capita (USTPO+EPO) (NRC9)

Entrepreneurship (NRC10)

Development & application of technology (NRC11)

Venture capital (NRC12)

GDP per capita at PPP (NFC1)

Government surplus/deficit % of GDP (NFC2)

Real government debt % growth rate (NFC3)

Foreign Debt % of GDP, government and business (NFC4)

US$ currency exchange rate, or weighted US$ & Euro (NFC5)

Long term interest rate (NFC6)

Effective country govt long term debt interest rate (NFC7)

Gross fixed capital formation per capita (NFC8)

Stock market capital formation as % of GDP (NFC9)

FDI inwards % of GDP (NFC10)

FDI outwards % of GDP (NFC11)

Value of special natural and financial resources /services, export – import as % of GDP (NFC12)

The countries are selected based on availability of reliable data to cover the 48 NIC indicators. List of countries are updated according to the available data.

NIC database covers Argentina, Australia, Austria, Belgium, Brazil, Bulgaria, Canada, Chile, China Mainland, Colombia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Korea, Latvia, Malaysia, Mexico, Mongolia, Netherlands, New Zealand, Norway, Philippines, Poland, Portugal, Romania, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Kingdom, USA and Venezuela.

Regions: Benchmark averages (Population, workforce and GDP weighted and direct) calculated for EU, EMU (Euro zone), Eastern Europe, Scandinavia, G8, G20, PIIGS, BRICS and ASEAN countries in database.

Additional: World, developed countries and developing countries in five (5) categories by level of GDP/capita and/or NIC advancement.

Intangibles disclose new perspectives to explain hidden economic drivers. By introducing the ELSS production function (ELSS: Edvinsson, Lin, Ståhle P. & Ståhle S.), a new theoretically and computationally justified method we have been able to catch and disclose those impacts. By augmenting the Cobb-Douglas production function with a wide range of NIC indicators, we have managed to uncover 77% of hidden economic drivers (TFP, total factor productivity) in developed economies and to calculate the effect of intangible capital on GDP and growth.

The results of our analysis show that intangible capital accounts for some 45% of world GDP. The figure for the United States is 70.3% and for the European Union 51.6 %. The Nordic countries stand out with a higher figure at 64.7%, with NIC contributing to 72.5% of GDP in Sweden, 69.7% in Finland and 67.6% in Denmark (2014).

"ELSS" refers to Edvinsson, Lin, Ståhle P. & Ståhle S.: Leif Edvinsson (Edvinsson & Malone, 1997) is creator of the IC model at corporate level, and Carol Lin is creator of the NIC model and the initial database of 40 countries (statistics mainly based on IMD Country Competitiveness data), which was further developed by Carol Lin, Pirjo Ståhle and Sten Ståhle.

The main framework for measuring the impact of national intellectual capital NIC on GDP formation and GDP annual growth was developed within the SAIKA project: Intellectual Capital as a Driver of National Economy, Finland Futures Research Centre, University of Turku. The project was funded by the Finnish Funding Agency for Technology and Innovation TEKES during 2010-2011 / 2012-2013. The head of the project was Professor Pirjo Ståhle and the head researcher was Chief analyst Sten Ståhle.

Since 2000 Leif Edvinsson has been the world’s first Professor, adjunct at Lund University on Intellectual Capital, and a leading edge on Intellectual Capital, IC. He was the worlds first corporate director of Intellectual Capital at Skandia in Stockholm, Sweden. He has been a key contributor to the theory of IC and oversaw the creation of the worlds first corporate Intellectual Capital Annual Report. Leif has been recognised with several awards for his pioneering work on IC. In 1996 the American Productivity and Quality Centre (USA) and Business Intelligence (UK) recognized him for the pioneering work on IC, and in 1999 Leif was noted the Most Admired Knowledge Award on Knowledge Leadership. In 2004 Leif was awarded The KEN Practitioner of the Year from Entovation International, where he also is an E 100. In 1998 Leif received the prestigious Brain Trust “Brain of the Year” award (UK), and in 2006 he was listed in a book by London Business Press, as one of The 50 Most influential Thinkers in the World. Leif is a cofounder and Chairman of The New Club of Paris, focused on the Knowledge Economy initiatives, and an associate member of The Club of Rome. In January 2006, he was also appointed professor adj. at The Hong Kong Polytechnic University.

Carol Yeh-Yun Lin is a distinguished professor and researcher in Intellectual Capital, IC, Department of Business Administration at National Chengchi University, Taipei, Taiwan; Taiwan Intellectual Capital Research Center (TICRC). Carol has achived several awards; the most recent is the Outstanding Teaching Award (2012), Outstanding Professor Award (2011), Taiwan Ministry of Education award; and Outstanding National Science Council Researcher (2011 & 2012). Carol is also a board member of the New Club of Paris.

Pirjo Ståhle is visiting professor at the Centre of Excellence in Laser Scanning Research, Aalto University School of Engineering. Her main areas of expertise are knowledge management, innovations and the measurement of intellectual capital. Pirjo St�hle moved to her current position from the University of Turku, Finland Futures Research Centre, where she served as professor from 2004 to 2013. At the Turku Futures Research Centre she was in charge of research projects concerned with the economic impacts of intellectual capital in 48 countries.

Pirjo Ståhle is often mentioned as a pioneer of Finnish knowledge management. She was the country's first-ever Chief Knowledge Officer (Sonera 1998-2001), first Professor of Knowledge Management (Lappeenranta University of Technology 2001-2007), and her book on Knowledge Management was the first Finnish book on this subject.

Chief analyst at Business Information Analysis and Consulting, bimac, Helsinki, Finland. He is a prominent researcher studying and modeling the impact of intangible capital on economic performance and competitiveness. Main focus areas are the measuring of intangible capital efficiency and determining the underlying inter dependencies of various intellectual capital components. Since mid 90’s he has been coworking in several publications (e.g. Intangibles and national economic wealth � a new perspective on how they are linked (2015), Towards measures of national intellectual capital: an analysis of the CHS model, 2012, Value Added Intellectual Coefficient (VAIC): A critical analysis (Outstanding paper published in the Journal of Intellectual Capital in 2008), 2011, National Intellectual Capital as an Economic Driver: Perspectives on Identification and Measurement, 2008) and in several projects (e.g. Educational Intelligence System EIS, 2006). Currently Sten is continuing his work within the ELSS project studying and modeling impacts of national intangible capital on economic growth and socio-economic change.